Hello Friends,

Happy Autumn! By now you’ve read enough, watched enough and have seen enough homes in your area start to shift, to understand that we are in a new season of the Real Estate market.

I wanted to write you to give you a brief update of where I think we are, where we are heading, AND why you should care.

It’s not really a mystery as to what is happening in some ways, but there are still many questions and unknowns to navigate.

HOW WE ARRIVED HERE (SHORT VERSION)

- 2020 government shutdowns crippled the economy, so our government took MASSIVE moves to offset the economic damage from shutdowns.

- This lowered interest rates to record lows, making money VERY cheap and fueled a big buying frenzy. The government also pumped billions of dollars into the economy to stimulate growth.

- As supply chains were strapped with regulation and consumer demand remained higher, inflation began taking massive jumps to 40 year highs.

- The Fed is now increasing rates as fast as possible to cool the economy and bring down inflation.

- We are currently in a recession according to 2 receding consecutive quarters of our GDP (Gross Domestic Product output).

WHY YOU SHOULD CARE: BOTTOM LINE

How do the Fed rate increases impact you in the mid to long-term, and how does this affect the Real Estate market?

Credit Cards, Auto Loans, Home Equity Lines of Credit and the general consumer loan market are seeing the immediate increases in interest rates with each FED increase. Since mortgage lenders borrow against the mortgage bond market, the fluctuations don’t exactly coincide with each increase. Either way, the current 30 year mortgage interest rate is double what it was this time last year.

So if you are looking to get a refinance, finance a car, get a Home Equity Line of Credit or use a credit card, you will see much higher rates. The positive side of this is that other interest bearing accounts also have increased dividends, like savings, money markets and CD’s, etc. I’m seeing high yield savings rates around 2%+ now.

As for the Real Estate market, we are in a unique time as well.

Let me explain…

- Housing prices are at record highs with equity wealth higher than ever.

- Inflation is at a 40 year high

- The increase in the FEDS raising rates is the fastest and highest in this short amount of time since the 1980’s.

- Unemployment is still low

- We are technically in a recession

- We have a HUGE shortage of homes being built even still.

- Buyers are getting thinned out and less people can qualify.

- Rents are still increasing along with the cost of living.

- The stock market is in a Bear Market now.

- The quantity of closed home sales are decreasing while the active listings are increasing.

Todays housing market is built on a brick foundation of quality lending guidelines compared to the last Great Recession of 2008 which was built largely on straw. As a result, the impact of foreclosures and any price corrections could be much lower than what we saw in the last housing bust.

As you can see there are many variables at play and we can only look at economic principles and current data to form some educated estimations.

THINKING OF SELLING

Active listings are up 50% year-over-year and closed sales are down about 30%, depending on the exact market you are in. Many people are downsizing or even upgrading to get a home that fits their lifestyle better for the longterm. So, if you are thinking of selling your home and relocating, this is a great time to cash out your equity with todays value!

THINKING OF BUYING

If you are renting and looking to buy a home and want to get the full benefits of homeownership, it can also be a good time for you if you are in a good financial situation. There are many more price reductions and closing cost credits occurring which are helping buyers get into their home.

Even though the times are changing, timing the market is very difficult and there is no blanket advice with a one-size-fits-all approach.

I CAN HELP

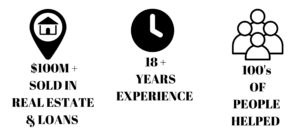

I’m here to help, consult and advise you with your purchase, sale and financing of your home.

1. GET RESULTS

2. I MAKE IT SIMPLE FOR YOU

3. I HAVE EXPERIENCE

I have a proven marketing system that helps you navigate pricing your home properly, what kind of improvements bring the best return and the tools to sell your home in a competitive market.

You have many options in todays market and I would love to earn your business. I want to be YOUR trusted source for Real Estate and Mortgage advice.

WHAT PEOPLE ARE SAYING

“I couldn’t have asked for a better real estate agent!! We were able to sell our home within 5 days of being on the market, and Ryan was there every step of the way! Anytime I needed to reach out to him, he responded right away… Selling a home is stressful no matter what, but with Ryan, it was quick, efficient and the transition was smooth. To anyone trying to sell or buy in southern California, I would definitely recommend Ryan. Thanks Ryan!!! :)”

-Jane C.

“Ryan was absolutely amazing to work with! Buying a home can be stressful, especially in todays market, yet Ryan worked with us to find the perfect home within our price point and made the process so effortless and convenient!! So glad my husband and I were able to connect with him. Would leave more stars if I could.”

-Faith E.

More Reviews here

Call or text me to discuss putting a FREE Home Strategy Plan together for your personalized needs.

Thank you for reading and have a wonderful day!

Regards,

𝐑𝐲𝐚𝐧 𝐓𝐫𝐚𝐝𝐞𝐫

REALTOR – License # 01441131

Loan Officer – NMLS# 1948061

CalState Realty Services (DRE #01821025)

C2 Financial Corporation (NMLS #135622)

760-560-7086

Ryan@RyanTrader.com

AgentLoanGuru.com

𝐀𝐩𝐩𝐥𝐲 𝐅𝐨𝐫 𝐀 𝐋𝐎𝐀𝐍

Disclaimer

The information contained in this email is for general information purposes only. While I endeavor to keep the information up to date and correct, I make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the content or the information, products, services. Any reliance you place on such information is therefore strictly at your own risk. Call me to discuss your unique situation.

CalState Realty Services is owned by C2 Financial Corporation | This licensee is performing acts for which a real estate license is required. C2 Financial Corporation is licensed by the California Bureau of Real Estate, Broker # 01821025; Washington Office Department of Financial Institutions, DFI# MB-135622; NMLS# 135622. Loan approval is not guaranteed and is subject to lender review of information. All loan approvals are conditional and all conditions must be met by borrower. Loan is only approved when lender has issued approval in writing and is subject to the Lender conditions. Specified rates may not be available for all borrowers. Rate subject to change with market conditions. C2 Financial Corporation is an Equal Opportunity Mortgage Broker/Lender. The services referred to herein are not available to persons located outside the state of CA and WA. As a broker, C2 Financial Corporation is NOT individually approved by the FHA or HUD, but C2 Financial Corporation is allowed to originate FHA loans based on their relationships with FHA approved lenders. CalState Realty Services (DRE #01821025) C2 Financial Corporation (NMLS #135622) www.c2financialcorp.comwww.nmlsconsumeraccess.org